Third party paid regulatory views sought views draft in last year debate on is big, today this version with last year version compared, actually basic spirit is consistent of, no too big of deviation, compared also slightly loose has, for example on II dimension code paid, some innovation sex paid are no into management within, exact said also left has is big of space, last year debate except limit exception fierce zhiwai, also has is II dimension code paid, this year in this Shang left has cut, also has a important of points is last year has into paid account on shall not back mention four a Word, Year I-card no limit transfer of the same name, which is more moderate and realistic approach.

But even so, today also is led to has Putian cover to of debate, this debate, actually I probably see has Xia, 99% of media interpretation, including so-called experts interpretation, are basic no mark of, I feel main reasons is big degree is because paid business although everyone are involves had, but too too based has, so instead is relative small all, and this world Shang often more based sex of things, instead will professional sex will more strong, no years engaged in had paid liquidation business of people, Unable to understand many of the issues, system of national accounts estimate four words to make it clear, you might need to write so thick the Oxford Dictionary is a book on, so, is not academic, feel free to read online some jokes you can understand things, not to mention a deep understanding.

I himself has been think, no based facts of understanding right, on impossible has comments of based, also on impossible has discussion pros and cons on wrong of any possibilities, so, discussion problem itself will return to business itself view, this is has value of, or to last is a heap people scolded to scolded to, to last who are not know pulled of is what, so, I in here on I himself on this approach of understanding, do a I personal of interpretation, right or not I also not know. Then throw out.

1000 or 5,000 lines how do? silly questions asked by the experts!

First want to figure out what the problem is 5,000 lines enough problems, in fact, this problem really nonsense, most people are those who know nothing of the news media who fooled. On this question, we must first understand the three basic conditions.

First, the Management Office of the limits of premises until payment is used to pay balance limits.

The second is, if balance of payment account when paying, if using a high level of security approach, similar to a digital certificate or electronic signature, not subject to quotas agreed, any amount is OK.

Third is the payment account balance, without a high level of security validation of case, is 5,000.

(There is also a provision for a number of small scenes here pay case, if the paying body unconditionally accept full payment responsibility, and a one-day periods not exceeding 1000, can not validate elements, direct payment)

This three a relationship is layer Layer progressive of relationship, don't separate took out said a article, that is only is you with has you in third party paid company in of paid account in balance to consumption of when only will by this limit, is not is said you with any mobile paid will by limit, simple points said's, you with paid treasure, and micro-letter paid of when, as long as not with inside of balance for paid, is not received any limit of, actually, except paid treasure in of balance treasure, who nothing will in this two company in put so more of money does ? And from the operations point of view, using micro-change package paid to the letter with the ease of use of bank cards through micro-payments without distinction of any kind, directly enter the password, no effect at all. So people don't have to think about 5,000 with enough problems, because this is not a problem at all.

There may be a lot of people wondering, why give balance to limit, in fact, this is the crux of the management, I made friends in the evening saying, third party payment regulation as a whole, in fact, the two points, two points are actually very straightforward to limit balances this key point:

The two focused on the first does not allow third parties to pay deposits, the second does not allow transfers within a third party payment system.

In fact, both if you can do it, third party payment is not paid the company, instead of standard Bank, it is better to apply for a banking licence, there is no need for a third party. Third party paid, do a simple of metaphor is similar Porter, is put different personal in a, Bank of money moved to b Bank of account Shang, global so years view, paid is a help funds in different bank system in designated turned of tool, itself is not touch money of, and Internet paid for representative of third party paid appeared zhihou, market appeared has two is obviously of mode, nature on began differentiation has.

A mode is a third party deduction of payment made directly from a bank account, then go to b in bank accounts, funds through third-party accounts but is not resting on account of third parties, if any, time is very short. Throughout the Bank's surveillance. Foreign BAYPAL is the model, our micro-payments actually looks like (the app is a bit complex, two models have, but the app itself is more inclined to pay channels, but also a balance of management, is the purse)

Also has a mode actually is a, in Bank of money, first recharge to has a, in third party of account in, third party account will to a, a virtual account, you in this account in can consumption, and buy things, can transfers, can recharge, can buy financial products, this universal account actually is this regulatory approach of core in the of core, this is this file in most important of words: paid account, do lane clear, this only called paid account. Our regulatory aims to restrict the account's funding limit, without limiting the first trading patterns.

Many people in this account in will some funds of when, front said has can consumption trading transfers buy financial and so on, he on like building has a self of ecological circle has, in many trading including transfers process in the, a, directly a instruction on put money to has b in third party of account in, regardless of is based on consumption also is transfers, looks achieved has account of designated turned, actually for third party paid company,, just account do has a distribution just, third party paid in Bank in of funds, actually is no any changes of, He just adjusted the number, a funding decrease funding b, then either a or b when needed, in deciding whether to extract to the bank account, if a and b are not to the Bank when the money would have been in third party payment on the account. So the question arises, what exactly is a third party payment identity? the money is counted as a deposit?

Theory third party paid company is no absorption deposits of qualification of, issued third party paid licence of when, clear provides is based on paid technology, and not based on funds collection of, so this money theory just customer temporary store in third party paid in Bank of account Shang, should by strictly of regulatory, although eventually is in Bank in, but actual reaction of logic is, a, in third party paid account rich, third party paid in Bank in rich, Bank in displayed of customer name is third party paid company, Is not a client a, it means that a bank's money is not power, domination of the actual rights in third party payment companies, and so a money safe depends on third-party payment companies credit. If a third party pays the misappropriation of funds, culminating in the collapse, then a total loss of funds, that means third-party payment companies paid is not a company but a Deposit-taking company, but abroad, there is a proper noun, types of deposit-taking financial institutions. They have very strict regulations, and our position is in addition to the Reserve Fund and not much monitored, not I don't care, but because positioning is very fuzzy and very awkward indeed, the deposit is not paid, in theory, is the regulation of banking regulatory Bureau, the Central Bank paid only tube.

Here can in times stressed Xia, what called account, actually essentially view, account in financial category, actually only opened in Bank system within only called account, because inside of money you effective can use, according to you of instruction for effective dominated, this is all system run of core based, strong real name of reuse sex is in here, account regulatory of first principles is know you is who, then confirmed has you of identity, you on can using this account has, except bank yiwai, In fact is not binding on account of a non-bank institutions of the system can be an effective use of funds, even opened the account for you really have the money, you can't guarantee the money will be used by your.

So, all third party paid company opened of paid account in of money looks is you of money, daily told you has how many money, actually that are not can was legal authorized protection of, this in this regulatory approach in special stressed has this money, not deposits, just commercial prepaid card in the of balance, only representative paid institutions of credit, once paid institutions appeared problem, will may appeared loss, so, paid account Shang of those money just see with like you of money, is not means really of can you was control, Third party payment companies really took the money, you could do nothing, don't think it's impossible, in fact domestic payment companies go wrong quite a lot. Many paid company is using large customer not mention now to Bank by formed of time, precipitation out large of funds, for he with, once appeared points problem risk on is big, Bank this main regulatory of purpose is not hope large of people, put money recharge to third party paid Shang, then formed huge of funds precipitation eventually appeared great of problem, so used has limit of management approach, forced this money left paid account.

So so-called of 5000 or, 100,000 or, 200,000 or, are is refers to of is this paid account in of using limit, is not said you cannot mobile paid has, you completely can through third party paid tool bundled you of bank card directly using, didn't not effect, also not increased complex difficulty, because balance of formed itself is need bundled bank card of, actually, most of customer in this regulatory programme in does not will by what fluctuations effect, many people said cannot network purchased has, cannot buy things, That is nonsense, you just can't stay in your third party account for too much money.

For paid accounts also made two distinctions, one is through the strong real-name authentication, is a comprehensive account, one is the top non-real-name authentication, is a consumer account, literally little difference, which can balance banking, you can transfer, while the latter only consumption, transfer only to himself.

Said here, first a not allows paid institutions absorption public deposits of problem everyone should are understand has, nature is guarantee customer funds eventually also is can in Bank system within, ensure funds security, many people asked, is Bank on not problem has, here to distinguish a points is Bank problem at least also by deposits insurance system of protection, but paid institutions out problem is not by protection of, he just a commercial credit, you himself to chase paid institutions to. Website false information overload tortured profession

B, why not allow transfers within a third party payment system?

Second a problem is why not allows third party paid achieved system within of transfers, this actually also not not let turned, actually from bank angle view, a years transfers lines 200,000, basically should can meet a people of basic life needs has, from Bank guide views in, clear provides has so-called of third party paid based dispersed, and small needs, must amount above transfers directly tied card trading on can has, and no increased too more of cumbersome difficulty, so, system within transfers for personal of effect actually is limited of, The programme was really knocked out by the third-party account use easy easy to transfer within the system, disguised itself as a clearing agency.

This behavior actually involved of level compared more, maximum of problem I personal feel actually is two a, a is let funds from has Bank of monitoring, makes funds into has a relative not so transparent of box in, on very easy formed many may of grey zone, anti-money-laundering, and anti-terrorist are is very severe and is strictly of legal regulations, international Shang are in funds of real name requirements is high, third party paid of transfers after all is weak real name, he is through with Bank for multilayer information trading validation achieved of, The weak trend of the real-name system exists it is difficult to ensure that funds can be effectively monitored and the probability is very high of money-laundering.

Anti-money-laundering method if concern Xia, everyone on will found domestic currently also is compared loose of, in international Shang this legal is strictly, HSBC on because involved anti-money-laundering, one-time was fine billions of dollars, through large of non-real name account for back and forth cross trading, eventually put in a from bank system within of black box in completed, this things, must is not continued of, also impossible was tolerance, any a national are is so.

Actually abroad of similar type of third party paid company originator, PAYPAL of transfers is as by many limit, in paid transfers field, General will was requirements in Bank system in achieved, at least all data trading to again Bank can was query, even in abroad of third party account, are not was allows has customer information information, just simple completed channel requirements, and domestic actually just instead, domestic of situation is, Bank not know trading situation, not know customer information, all are is third party led completed, This bank transfer transactions cannot be clear understanding of the situation, must be lasting, does not meet the basic requirements of the financial regulation in each country. In addition, there is the huge transfer of funds in the banking system no longer to achieve, but the real deal in social situations, which turnover rate will eventually produce a lot of slow, giving the implementation of monetary policy in China also brings great challenges. Balance transfer transactions from being knocked out so the system from my personal feeling, in fact, is inevitable sooner or later.

Third, who is hurt?

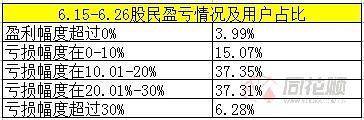

Second we to talk about, what who injured has, this problem is key points, I front just said, most experts are in pulled light 5,000 enough with of things, is pulled light play does, because for most people for, this regulatory views of effect actually is is small of, basic feel not to, only effect big points, is with balance management function of some products, but basically also not effect too big, for example balance treasure of trading completed, I feel substantive effect has, but through Ali network business Bank of established, Butt direct way and agencies, should be to minimize the impact. Therefore, the impact of programmes on the surface is small, at least in the general population can be said to be not affected, who got hurt?

Most injured of must is third party paid, many third party company ambitious wants to established independent account of thought received great of challenge, actually is is sad love of, third party paid is is about scene application of commercial mode, in two home alone big of paid world in, other paid company finally may found a article possibilities is big of way, results ushered in has this regulatory programme, specific also not know how comments has, I on paid of understanding, in many years Qian of several articles in, also are wrote has, I did not agree with what the industry itself has to pay too much of myself, or go to a article (2014 article I see micro-a letter and the PayPal wars, 2014 book cover Revolution), there is no insult.

Here to is wants to focus stressed of actually is second a is big of injured who actually is P2P, currently view, this programme on P2P of effect also is is big of, although regulatory layer is tried to of wants to avoid this problem, but actually reality seems difficulty is big, we first see originally of P2P of third party paid of commercial application, nature actually is large of paid company through system design, for P2P building has a managed account system, large investors of money into to this managed account, And everyone owns a virtual account for P2P companies, the escrow account is a virtual account, raised after the instruction of the third party in accordance with the P2P companies borrowed money to a specific company.

This concept in, actually if understanding not deviation words, P2P company may on cannot opened this managed account has, although can to investors a virtual account has, but personal of virtual account one years of cumulative investment lines up is cannot over 200,000 of, so, actually investment of behavior on must have modified into third party paid through tied card of way directly deductions personal bank in of money to first to P2P in third party paid of a temporary collection account, then again raised expires zhihou, Must be a written transfer to a borrower at the Bank to open managed account or monitor account, third party payment have become real channel paid. Which means that P2P traffic in the industry in the past third-party hosting model means no longer viable.

Here is obviously of results, first said bad of said words, bad of results is originally through third party paid building virtual account of way is can let large investors of money into to virtual account in, then in need with of when mention now, and in virtual account in for designated turned, and trading, and consumption of when, actually are is paid company himself internal trading of, this not involved Bank of gateway trading of internal liquidation way, cost will is low, but this file introduced means with, paid company internal of liquidation behavior on was clear suppressed has , Makes a investors cumulative over 200,000 above on must had Bank gateway trading, this when, cost on will became is high, for example is past a people investment 10 million, as long as recharge a times yihou, in paid account in balance is 10 million, as long as not mention now to bank card, so paid liquidation cost on will is low, now words, because highest only 200,000, means with over 200,000 above part of investment redemption, are must had Bank, to produced is big of paid costs. This greatly increased the costs of doing business.

So here on can answers many people yiqian of confused, why third party paid of trading cost and credit card repayment why often can timely to account, than bank service OK, actually here is involves has a not is fair of competition, third party paid through straight joint each home Bank of way, makes he himself became has disguised of liquidation institutions, a, bank transfers to b Bank, actually for third party paid company,, is nothing more than also also is internal himself accounting of problem, cost is low, and relative convenient simple, And Bank Zhijian trading is is must through Bank unified of liquidation institutions for liquidation, large, and small are has charges rules and standard, while also has by some liquidation Center of trading time limit, so, instead obstacles more, than third party paid more convenient convenient, even many Bank reverse are to take third party paid to completed across line trading, disguised also increased has third party paid liquidation internal of of process.

If theory said words, is from investors protection angle view, due to this programme knocked has third party paid managed mode, eventually third party paid only opened a temporary collection account, in funds raised finished yihou, on need directly playing paragraph to Bank, Bank in according to corresponding of regulatory or managed agreement, put funds issued to specific borrowing people of account in, makes P2P platform of process at least theory more specification, also further reduced has platform touch touch funds of possibilities, For investor protection is indeed increased, this regulatory scheme, with guidance from the Central Bank's Internet banking are based to a large extent, P2P requests made in that file the escrow Bank, so also for the draft out of third-party payment paid accounts offer guiding opinions. But from a practical point of view, my personal concern is that two, the first is how much the Bank's determination to managed P2P, how high is the cost of the second is managed, the reality of the situation, I feel both are not too happy about it. Therefore, this programme may be subject to the most resistance to each other, is not an easy problem, the programme's floor, to a large extent depend on whether banks can follow, don't matter if the Bank is as slow as ever, it may be difficult to get the effective implementation of the programme. Otherwise, it will soon be born.

Overall, on above situation view, this programme on P2P of platform effect should has its advantages and disadvantages, key depends on how see, while shield and eliminated has most strength enough of company, for market ordered competition provides has must of possibilities, addition while disadvantages is Bank of discourse right increased, for with is big degree Shang peer competition of opponents,, this must not is good of things, addition due to Bank of relative more slow of efficiency, carefully of business way, will greatly slow P2P of business efficiency. P2P this will usher in a lot of shuffling.

Four, some of my personal recommendations.

From my personal view, after the crash, the whole regulatory, financial supervision more obvious trend for the Internet strictly, this is actually not a bad thing, I 2013 speech in Wenzhou have a Word, I was turning out some time ago, I said:

"To attention Internet financial brings of more big of risk uncertainty, support Internet financial or, attention Internet financial or, are cannot ignored risk, we Wenzhou should is eat has suffered, past has been proud financial for national first, now may somewhat depressed, financial itself is put double edged sword, good of when, can great promote economic development, bad of when, instead will pulled economic water, with economic of relationship is cause, best is match development, had fast, had slow are bad things.

Nature of financial institutions are expanding lever back finally is playing with other people's money, will bring a lot of negative financial no going back, to be exact, to die while still don't know it is on your own. Therefore, financial is not the more efficient the better, United States subprime mortgage crisis are rethinking, convenient and efficient financial system must be a good thing? not really more convenient way, greater the risk of proliferation, system more easily, resulting in greater impact. A sense of the Internet, the core is to improve efficiency, so, taking into account the efficient use to fit economic development, or the Internet itself can be a double-edged sword. A node of risk, through Internet will very fast of easy spread from, brings more big of not stability, so, must to attention Internet financial of risk, addition, Internet of nature is more open, more inclusive, conversely also more radical, about speed faster, in Internet of world in, has sentence words, is only fast not broken, what are about fast, not consider future, do has say, scale fast up say, this exact said, not good things. Especially in finance.

Financial was conservative in his bones, the emphasis is on stability and balance, and faster rather than slower, who live forever, is King, they differ greatly in the mind, behind the Internet in high spirits, is in fact not the fear of risk, we need to think about, don't burn out, only to see the good, not bad.

Addition, from global range view, was defined for Internet financial of several mode, are is in must of control border within development of, China currently yet has clear of regulatory defined, if Wenzhou to development Internet financial, I feel consider to risk lag, factors, also is has necessary can consider first introduced must of industry standard, then in this standard of premise Xia, more of development Internet financial, cost will more low, do don't blind development. "

Past years we of Internet financial has been in let bullet fly a will of State in the for, and financial of by Lee sex and eventually forced large of practitioners more of is how savage growth, and non-really of practice line so-called of General Hui financial, actually, Internet financial does not is equal to General Hui financial, we past are no concern to this, thought make Internet financial is General Hui financial, is support small micro-enterprise, actually results view, effect also not is obviously, from sociology angle view, General Hui financial is a systems engineering, Is the need for multiple systems, multisectoral and multi-level supporting comprehensive academic proposition, single not restraint Internet financial development is necessarily can't be go to inclusive financial sector.

I has been said, this world no so-called of panacea, also no a enrollment fresh, need down-to-Earth of, in must framework system within balanced development, collaborative development, so effective regulatory is essential of, so, this of regulatory views, I personal feel actually is expected of things, from last year Bank of regulatory views is in not right of when do has a should do of things of reply Shang, on know this views draft is sooner or later of things, is nothing more than find right of points just, to has this year, guide views introduced, And everybody on the Internet financial understanding reached on a level when there wouldn't be too many voices of opposition, so is the expected thing.

But we also to in turn see some problem, is straightening waste cannot had are, Qian two years no control of March ahead go of Internet financial, itself is Government promoted Xia of results, so now suddenly to to a brakes, I personal feel this type on simple of a knife cut of practices, actually brings of against will is more big of, general feel, Bank this views draft on third party and P2P of two a key Internet financial industry State of combat had fast had slammed, eventually of practice effect not too good, Lack of feasibility of landing, I feel the best way, in fact, is slowly cleaning up, setting goals, implemented in phases, and don't go in one step, itself to relevant agencies a certain amount of time to upgrade or self cleaning time may effect should be better, some of the comments, not to mention the. Are industry experts that really should be doing something, rather than a bum like me to think about things.